ESG Model

Download the Sustainability Rating definitions guide. For further documents go to the rating page.

A unique ESG Model

Standard Ethics adopts the notion of Sustainability proposed to the UN in 1987 with the Brundtland Report "Our Common Future": "A development that satisfies the needs of the present without compromising the capacity of future generations to satisfy their own". It is a planetary theme, linked to human knowledge, to face the great climatic, social and economic phenomena because they go beyond the borders of a nation and the perimeter of a company.

Standard Ethics believes that Sustainability means aligning business activities with a collective planetary effort and for this reason its model is exclusively inspired by the principles and guidelines of the European Union, OECD and United Nations.

Only by measuring said conformity with comparable, transparent and third-party methodologies will it be possible to ascertain the degree of sustainability of an economic entity and its effect on tomorrow’s generations. See Three Cornerstones of Sustainability.

The competitive advantage of the Standard Ethics model is simple:

- EU, OECD and UN recommendations suggest future legislative requirements. Companies, organizations and countries adopting the Standard Ethics model will have a competitive advantage compared to those not complying with the recommendations;

- The principles of the EU, OECD and UN are universal and shared by all major international stakeholders;

- Companies and their stakeholders can easily focus their discussions on common targets already discussed at international level, matching common views about the road map.

Standard Ethics Algorithm©

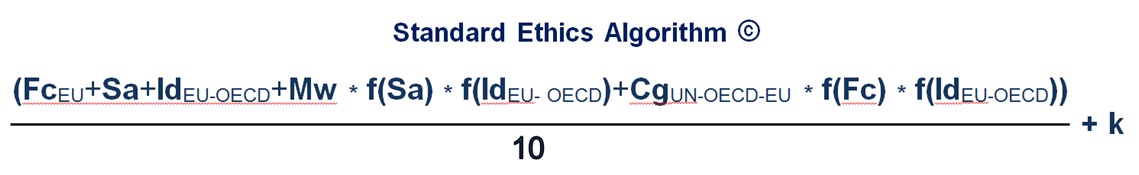

Thanks to this approach, the Standard Ethics model is the first to be based on a standard Proprietary Algorithm.

From this standard proprietary Algorithm derives the algorithm relating to the evaluation of General-Purpose Securities issuances (General-Purpose Securities Rating)

To ensure accuracy and comparability, Standard Ethics does not use weights and KPIs based analyses or indicators, but a more sophisticated method based on its own six-group variable algorithm, five “standards” and a premium variable called “k”. Standard Ethics does not use Artificial Intelligence in its analysis or decisional process.

- The first variable of the formula (Fc ) is related to competition, which positively evaluates the company that competes and faces the market in an appropriate way. While it views negatively risky elements such as antitrust, investigations, fines or sanctions, tax evasion or simply a position of privilege that could, in the long run, prove problematic.

- The metric of the second and third variables (Sa and Mw) is also linked to typical considerations for many long-term institutional investors and analyses the importance of sensitive aspects for minority shareholders or for new shareholders, for example, with regards to shareholder agreements (not justified by operational needs), double voting rights, the presence of a controlling shareholder, conflicts of interest, and low contendibility.

- The fourth variable (Id) looks at managerial scope, risk management and control as well as the reporting models and the composition of the Board of Directors, including areas such as independence and gender equality.

- The fifth (Cg) focuses on ESG factors: to see if the company is aligned with strategies such as the Paris COP21 for the reduction of climate effects or the OECD guidelines for multinational enterprises as examples.

k = Sustainability at Risk (SaR)

The relationship between these variables is significant: it would be inconsistent for a company to propose itself as sustainable with the aim of publicising environmental factors, if at the same time it made it difficult for investors because of little transparency, or if it infringed the rules of the market with unfair fiscal or competitive practices.

The Sustainability package, as we are reminded by the OECD and the EU, is complete if it includes all the factors that make the company an asset for future generations.

This Proprietary Algorithm evaluates these elements and weighs them in a harmonious way making the rating of Standard Ethics a best practice of comparable, public and several-times-a-year analysis on sustainability.

Analysis Points

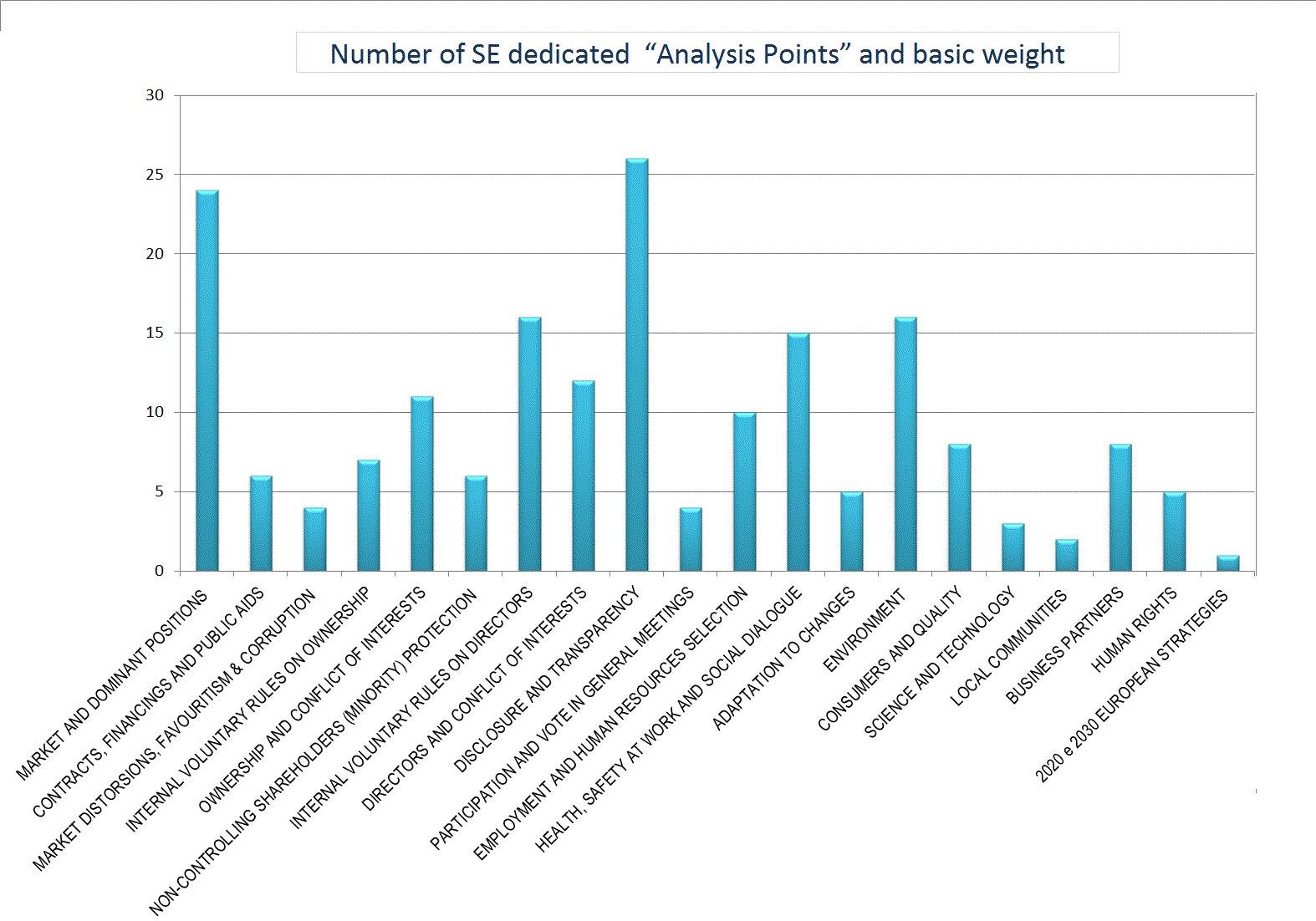

Standard Ethics analyses various aspects of environmental, social and governance (ESG) issues which are summarized in the chart below.

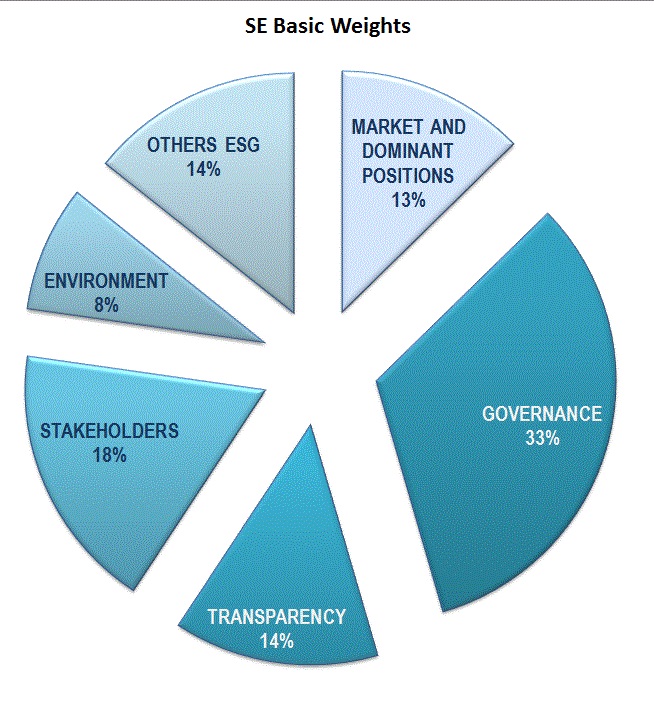

Then, these analysis points which we call 'markers' and help Standard Ethics to better evaluate the company under rating, are grouped into further macro areas. The following chart shows their relative percentages, which are subsequently weighted by the Standard Ethics Proprietary Algorithm.